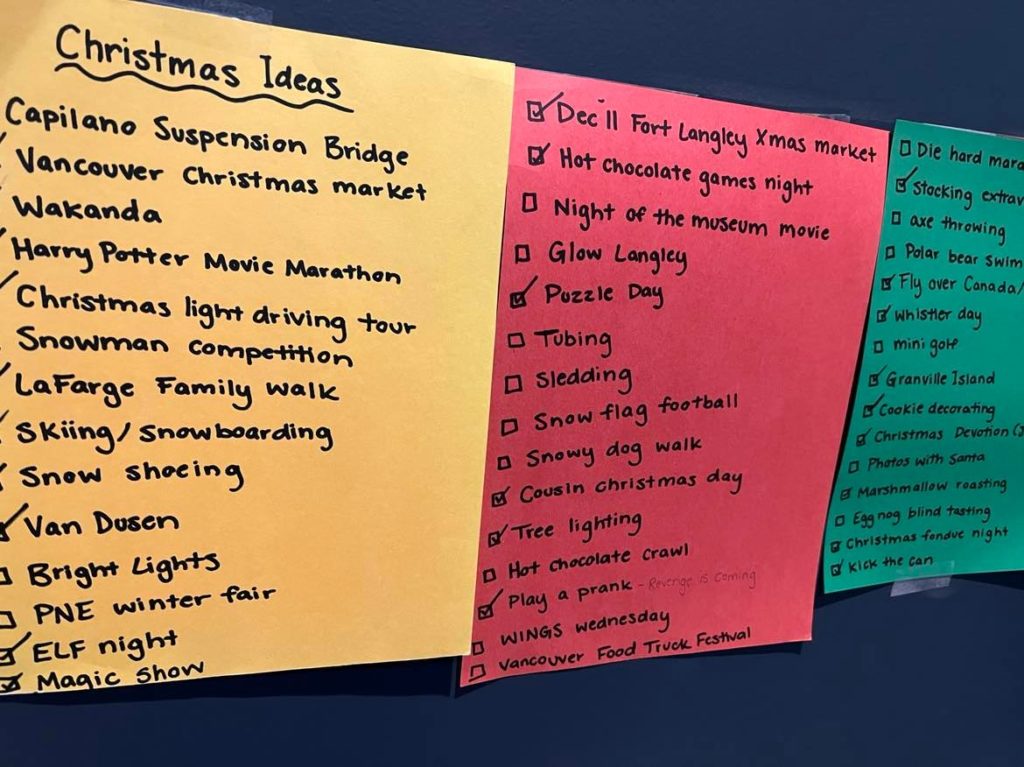

Happy New Year! I hope everyone found that magical balance of rest, rejuvenation, and fun over the holiday season. I spent a couple of weeks in Qatar at the World Cup beginning in December and had to spend the Christmas season making up for it with the family. It’s the longest I have been apart from the family since I married. I usually try and rest and recharge over Christmas, but my daughter had a three-page holiday activity list we had to work through, and I had no credit available for refusing anything.

Worth it, though! Bucket list trip for me, and if you didn’t enjoy the World Cup final, then I feel you must be emotionally stunted inside!

The end of the year is a time of reflection for most of us, and I can never figure out how time seems to both fly by and feel so slow.

Despite the risk of them triggering seizures, I enjoy those 1 second a day or 2022 in 22 seconds Instagram posts. Amazing how much gets crammed into a year’s worth of living and how fast it goes! So much truth in the saying “the days are long, but the years are short”!

Last year I was lamenting that COVID restrictions were tightening up again as Omicron was making its rounds. This year we have the ominously named “Kraken” variant to worry about. It feels like they are trying to make more and more sinister names for the variants to keep it at the forefront of people’s minds. Mortality rates are way down from a year ago, but hospitals are still stretched thin. Ironically enough, beds are filled with cases of normal flu/respiratory illness as the general population’s immune systems are compromised from three years of COVID protocols.

I am interested in looking back at this period through the lens of hindsight in 5 years or so! Regardless, lessons learned from the last three years suggest it is improbable that the global economy is in any danger of shutting down again anytime soon.

Markets had their worst year since the Global Financial Crisis, and bonds posted their worst returns since the Great Depression.

The fact that this happened simultaneously makes this easily my worst year since I started in the business 25 years ago. My kids have started a disgruntled investors club protesting my portfolio management skills, but there really wasn’t any relief to be found anywhere in 2022. Official numbers had the S&P 500 down 19% for the year, Nasdaq dropped 33%, and bitcoin went from the top-performing asset class in 2021 to losing 75% of its value in 12 months! The main culprit was inflation, which hit a 40-year high on a month-to-month basis, and interest rates jumped from 2.45% to 6.45%.

Economic news has been depressingly entertaining. Liz Truss served the shortest tenure as Prime Minister of the UK, only holding office for seven weeks. She was ousted after her government came out with an economic plan so bad that the IMF told the UK they might want to “rethink” their budget!

Elon Musk paid $44 Billion to buy Twitter, seemingly because he was double dog dared to do so. Tesla has always traded a bit like an Elon trading card. You were paying a premium for the car company because Musk was the darling of the media and his association with green energy and SpaceX – he was Time’s Person of the Year in 2021. As his political views alienated more people and his business acumen got called into question with the Twitter debacle (although I find it interesting that it seems to be running just fine, even after firing 50% of the staff), that shine is tarnished. Tesla lost 75% of its value in 2022. That works to approximately $650 million in real dollars in market cap or more than any publicly traded company in America other than the top 5.

Republicans squeaked out a majority in the house in the November elections. Not the red wave they were hoping for. Watching them try and elect a house speaker has been a reminder to stay out of politics! No worries, though; George Santos says everything is fine over there!

Canada just passed Bill C-32, which includes an extra $2 Billion to establish the Canada Growth Fund. Essentially, we bought shares in a corporation that has yet to exist and has no information on how it will be spent, controlled or governed, but it is apparently really important to the green transition because of climate change and Americans.

You legitimately can’t make this stuff up!

No wonder “Wednesday” was my favourite Netflix show over the holidays. I’ve become desensitized to the world’s weird, wacky, and slightly dark humour to the point where watching the Addams Family feels normal!

When optimism is in short supply, it is essential to keep perspective. Despite the attention-grabbing nature of negative headlines, most of our reading carries little consequence to long-term investors. The damage to the stock market happened in the first six months of the year. We have been in a holding pattern since (most markets are positive last half of 2022). The individual stories are interesting, but the macroeconomic picture is in the driving seat.

Markets are still waiting to see where inflation peaks and where interest rates stick. I have been talking about the same story for the last six months, but this is the only narrative that matters. The problem, of course, is that you have to wait a few months after each rate hike to see what inflation is doing. Very difficult to hold anyone’s attention. Much more interesting to be reporting on the collapse of cryptocurrency exchange FTX and where Sam Bankman-Fried siphoned off those billions of missing dollars. Fun to speculate about, but not something that factors into our investment discipline.

The biggest losers last year were growth companies.

Technology is one of my favourite sectors, but it was down 33% last year. Amazon lost half its value despite its earnings being double what they were two years ago. The worry is that higher rates will squeeze the margins of those companies, and the economy moving into recession will shrink sales in the future. Both are likely true in the short term, but I have a hard time seeing any company challenging the moat around Amazon’s business anytime soon. My real question would be, “are any of these areas going to stop growing?”

The biggest tech story of the year is AI being capable of design. Artists are winning art contests with AI-generated art pieces where you simply put in the criteria for what you want – moonlit beach, couple having a glass of wine, etc. Programs like Midjourney will generate an original picture based on your input.

OpenAI has a program called ChatGPT (free right now!) which will answer any questions you have. It generates college-level papers that pass robot plagiarism algorithms. It can create lesson plans for teachers and fitness plans for athletes and carry on conversations through chat boxes where you wouldn’t even know you were talking to a computer. It’s like having a friend who has read the entire internet available to answer your questions.

AI being capable of design is slightly terrifying in terms of social implications and even more frightening in terms of economic potential.

There are possible applications in robotics, learning, natural language processing, predictive modeling, customer service, and healthcare, to name a few of the sectors that will benefit from this technology. These are just a few examples I got according to my query of my new ChatGPT buddy!

Nobody is looking at the balance sheets or earnings of individual businesses. Nobody is looking at fundamentals. Growth companies are all tarred with the same brush of worry over interest rates and recession. Interest rates at 7 or 8% are jarring when we have gotten used to rates at 2.5%, but these are normal rates. Businesses and economies were able to function just fine in the past at these rates; they are going to adapt and evolve and operate just fine at these rates in the future.

The bottoming out of an economic cycle and recession are normal and necessary for long-term financial health. When everyone else is moaning about the economy is precisely the time for intelligent and disciplined investors to look through the negative headlines and load up on quality companies with durable businesses that are trading below value. There are a lot of them out there!

World Cup in Qatar was an incredible experience. I don’t know if we will ever get a “one-city” world cup again. The entire country is under 3 million people. The average government spends about $2 billion in infrastructure expenditures when preparing to host a World Cup, and that is spread out over a vast area. Qatar paid $220 billion for the one city! The combination of not being as easy to bribe FIFA anymore and Qatar being one of the very few countries willing and able to spend a fortune on a one-off event as a means of branding their country means that I will be surprised to see anything like it again in my lifetime.

New stadiums, new transportation, new hotels, air-conditioned outdoor streets, and a million workers brought in to ensure everything ran smoothly made for an incredible experience. I took Uber to stadiums, paid through Apple Pay on my phone, and booked restaurants through my Open Table app. Technology is not a short-term wave. It is a sector that is going to continue to evolve and expand.

My lasting impression from the World Cup, though, was one of hope. A million or so people came together to watch soccer. We watched games with fans from Europe, South America, Africa, and the Middle East. Everyone was in a good mood; the fans intermingled and bonded over the games, and the residents of Qatar were happy to show off their country.

It was a reminder that although it is the negative headlines that dominate media and feel so consequential and weighty, there is plenty of empathy, enthusiasm, and hope out there as well.

Everybody just needs to become a soccer fan!

I look forward to connecting with you over the next quarter to catch up and review your accounts. I am genuinely optimistic about what this year will bring us!

Stay disciplined, be optimistic!

Jeremy Low

The information provided here is general in nature and should not be considered personal investment advice or solicitation to buy or sell any securities. It may include information concerning financial markets as at particular point in time and is subject to change without notice. Every effort has been made to compile it from reliable sources, however, no warranty can be made as to its accuracy or completeness. The views expressed here are those of the authors and writers only and not necessarily those of Worldsource Securities Inc., its employees or affiliates. There may also be projections or other “forward-looking statements.” There is significant risk that forward looking statements will not prove to be accurate and actual results, performance or achievements could differ materially from any future results, performance or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Before acting on any of the information provided, please contact your advisor for individual financial advice based on your personal circumstances.

Worldsource Securities Inc., is the sponsoring investment dealer and the member of Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

leave a comment