Happy December! I hope everyone enjoyed the first snowfall of the year! Something is refreshing about waking up for the first time and seeing everything blanketed in white. I find it emotionally soothing when all the dirt and clutter in our yard gets hidden under the snow. That feeling doesn’t last long, as it disappears once you have to go outside and shovel the driveway! Even that brings a smile to my face the first time I have to do it though, as I don’t think my dog is ever happier than when we are outside with her on a snow day!

Lots of turmoil in the market last week in November as markets reacted (euphemism for dropped like a rock) to the Omicron variant bringing travel bans and fears that the economy could go backward with restrictions. Governments got a lot of criticism for not acting quickly enough on the last go-round, so the reaction to this new Covid strain was rapid but feels a bit premature.

Many questions still need answering around contagion levels, vaccine effectiveness, whether it is worse than the Delta variant, and just its general danger level. It doesn’t help ease the fear factor when “Omicron” sounds like the name of some super-villain out to end the world!

I am by no means dismissive of the threat COVID represents, but at this point, I feel that we are rapidly moving towards the phase where it becomes endemic. It’s not going to go away, there will always be some risk, but that risk is going to be both manageable and acceptable enough for us to go about our daily lives. The question for me is simply how long until we get there?

A new generation of Covid treatments will be available soon, one from Pfizer, one from Merk, which can substantially reduce hospitalization and death.

From my layman’s understanding, they are pill regimens taken after a positive Covid test that help turn it into a more common respiratory disease. This, along with increased vaccination rates and booster shots, will eventually tilt the world back towards normalcy when the risk of Covid becomes less than the weight of the pandemic’s huge social and economic side effects. I feel we are already in that place, but recency bias prevents us from adequately quantifying the psychological and financial costs of restrictions and isolation policies against the dangers of Covid right now. This feeling is also tempered with the acknowledgement that there is still much we don’t know, and while I am optimistic, I am also cautious about the risk of being wrong!

My perspective means that I feel market pullbacks on Covid fears represent legitimate buying opportunities to judiciously pick up quality companies at discounted prices.

Perspective is a funny thing. Many biases creep into our thinking due to heuristics – that desire to find shortcuts that allow us to simplify our choices and judgements.

Lazy thinking is the result of so many problems! This past weekend, I was reminded of that when my wife and I went Christmas shopping together.

Kristy and I have way more in common than differences regarding values, interests, and our thinking, but we profoundly diverge when it comes to shopping preferences. Kristy is fundamentally cheap, while I tend not to look at prices too closely. We had spent the night downtown for our office Christmas party and dedicated the next day to braving Pacific Centre to knock off our Christmas list.

I was convinced that we could get all our shopping done at Nordstrom, while Kristy was equally convinced that this was stupid. My wife, having been married to me for over 25 years now, knows that was not the correct argument to make to get me to change my mind, so she very sweetly suggested that we start at Old Navy and H&M for “perspective” before we went to Nordstrom. I can’t even remember the last time I was in an Old Navy store, but it was truly eye-opening to me how far a dollar stretches there. I’m pretty sure Kristy filled two full bags with clothes for the same price as the one sweater I ended up buying at Nordstrom! I don’t think either one of us was fully converted to the other’s way of shopping. Still, I did finish the day with some appreciation for the value on offer at Old Navy and Kristy acknowledged that some of the merchandise (very little in her opinion!) might be of high enough quality to be worth paying for at Nordstrom. A good shopper can separate value from cheap, quality from overpriced, what is worth spending money on, and what is not, regardless of its label.

The market is just as guilty of discrimination as any other individual or entity. Markets are shifting out of growth companies (think more expensively priced) into value companies. This factor rotation is a bias that may hold some short-term basis in truth for the market as a whole but will not hold true for individual companies. I am happy to be shopping for stocks right now as I think there are a lot of good companies out there that are being arbitrarily and unfairly labeled as too “growthy” and lumped in with more speculative companies that are rightfully falling. For the companies where nothing has fundamentally changed, secular tailwinds remain strong, and future growth looks assured; this represents opportunity. Just as the snow eventually melts away without changing what it covers, the short-term noise of headlines will disappear and ultimately reveal whether or not a company’s future growth has been fairly valued. Perspectives shaped through heuristics rather than unbiased critical thinking create market imbalances that can be exploited.

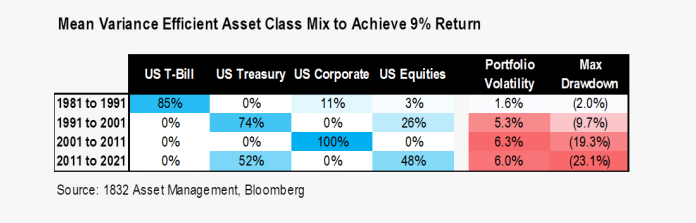

As much as I like to talk about opportunities and sales, I fully acknowledge that living with market volatility is gut-wrenching. Not sure if it is going to make you feel any better or not, but I came across this chart in my readings this last week:

More risk needed to generate similar return

Mean Variance Efficient Asset Class Mix to Achieve 9% Return

Source: 1832 Asset Management, Bloomberg

In a simple exercise, we determined what a portfolio designed to achieve 9% annualized returns would have looked like in each of the past four decades from 1981. These maximized Sharpe Ratio portfolios for each decade became riskier. Return streams were more variable while max drawdowns increased in size.

Markets don’t just feel choppier these days; they are statistically more volatile than ever. In the last decade, to achieve the same 9% return as in previous decades (using hindsight and the statistically least variable asset mix possible), you needed a much higher percentage of your portfolio in stocks with more volatility and a strong stomach! Your max drawdown in the eighties was -2%, compared to a -23% drawdown over the last decade. And that’s assuming you had the perfect asset mix to start (which no one does!). One more reason to pine for the good old days! I started in this business in 1998 – right when that market volatility and max drawdown rate doubled! I’ve been trying to manage client emotions just as much as portfolios my whole career!

I have found when I am doing planning work with clients, that acknowledging Vancouver doesn’t just feel expensive is important. Statistically it is one of the most expensive cities in the world to live. Understanding that helps validate the trouble Vancouverites are having with saving enough for retirement. I’m showing you this chart in the hopes that it helps similarly with understanding portfolio construction these days. Good returns are still possible, but it comes at the cost of some big investment swings. If you are unwilling to live with a -23% drawdown on your account, you have to adjust your growth expectations downwards because this trend is not changing anytime soon!

The key is to set and understand your risk and return expectations pre-emptively to mitigate (you are never going to avoid them altogether) surprises, and then trust the investment process. Having the discipline to stick with foundational principles in managing accounts will help get us through these choppy waters!

I’m off to England with my youngest son this week. It’s a right of passage to take each of my kids to Manchester to watch United play at Old Trafford, and with my older two having already made the pilgrimage, it is Jordan’s turn. The trip initially got put on hold during Covid, but with Jordan in grade 12, we couldn’t wait too much longer. We’ve got six games planned over the next ten days – I’m really hoping that Omicron will not cause too much more market volatility, but most importantly, I’m hoping that the stadiums in England stay open!

Stay safe, stay positive, stay disciplined, and have a fantastic holiday season!

Jeremy

leave a comment